How Should a Business Handle Surplus Inventory?

September 7, 2025

Surplus inventory is a reality that most businesses face at some point. Also called excess stock, overstock, or

inventory overhang, it refers to goods that remain unsold beyond expected demand. While it may not always be completely unsellable like dead stock or obsolete inventory, surplus can drain cash flow, increase warehouse costs, and put pressure on profit margins if not managed properly.

For small and mid-sized businesses in particular, handling surplus inventory effectively can mean the difference between protecting financial health and suffering significant losses. In this article, I’ll break down the risks, causes, and proven strategies businesses can use to manage and prevent surplus inventory — drawing on both industry research and real-world experience.

Why Surplus Inventory Matters

Holding too much stock has both financial and operational consequences.

From a financial perspective, unsold products tie up working capital that could otherwise be reinvested in growth opportunities. Businesses incur inventory carrying costs such as warehousing, insurance, depreciation, and even shrinkage (loss due to theft or damage). Industry reports suggest these costs can reach 20–30% of a product’s total value annually.

Operationally, surplus stock increases complexity. It takes up valuable warehouse space, increases the chance of misplacement, and creates inefficiencies in e-commerce fulfillment. For perishable or seasonal items, the risk is even greater:

unsold products can quickly become obsolete inventory, leaving businesses with zero recovery options.

On a broader level, excess inventory also impacts brand reputation. Frequent discounting or clearance sales may condition customers to wait for deals, weakening long-term pricing power.

What Causes Surplus Inventory?

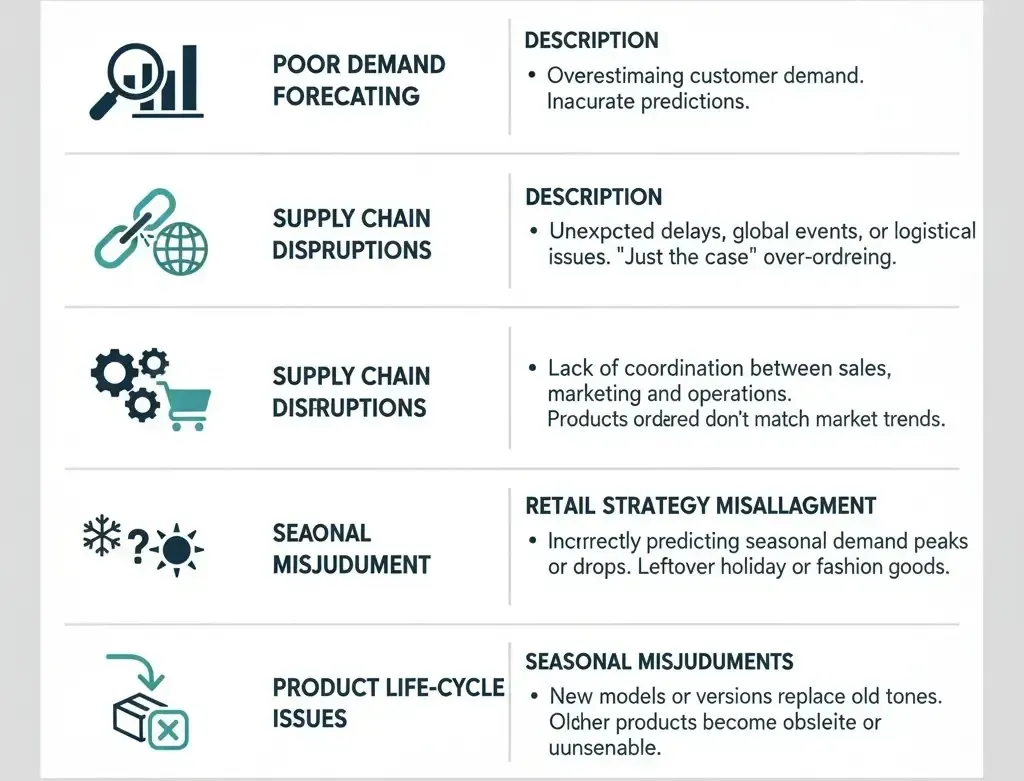

Understanding the root causes of overstock is the first step toward managing it.

- Poor demand forecasting – Overestimating demand remains one of the most common reasons businesses end up with surplus.

- Supply chain disruptions – Delays and global shocks often cause companies to over-order “just in case,” leading to inventory overhang.

- Retail strategy misalignment – Lack of coordination between marketing, sales, and operations can result in ordering products that don’t align with actual demand.

- Seasonal misjudgments – Fashion, holiday, or event-driven businesses often face excess goods when consumer demand shifts unexpectedly.

- Product life-cycle issues – When new models or designs are introduced, older versions can become unsellable, creating dead stock.

The pandemic highlighted how quickly these factors can combine. Many businesses increased orders to safeguard supply, only to face declining demand and warehouses full of unsold products.

How Data and Technology Can Help

Businesses today have access to advanced inventory management systems that use real-time data and AI-driven algorithms. According to industry case studies,

companies that adopt advanced demand forecasting tools can reduce excess inventory by 10–35%.

For example, global brands like Castrol reduced finished goods inventory by 35% while improving service levels by nearly 10% through better optimization. Similarly, a UK distributor reported profit increases of over £36 million after adopting advanced inventory systems.

Modern tools leverage techniques such as Monte Carlo simulations, machine learning models, and demand-sensing algorithms to fine-tune purchasing and stocking decisions. For small and mid-sized businesses, adopting scalable software for supply chain management and loss prevention is now more accessible than ever, helping them minimize risk and safeguard profit margins.

How to Handle Surplus Inventory Today

When a business already has excess stock on hand, the priority is to recover value quickly while minimizing long-term damage. Below are the most effective strategies:

Selling Options

- Liquidation –

Selling to a liquidator or wholesaler provides immediate cash recovery, though at a lower margin. This is common for businesses needing to

free up cash flow quickly.

- Discounting & clearance sales – Marking down products to move them faster.

- Flash sales & promotional offers – Creating urgency for customers to purchase.

- Bundle deals – Combining slow-moving items with fast sellers to increase perceived value.

- Off-price retail – Selling through discount retailers or secondary markets.

A National Retail Federation study notes that retailers typically recover 20–50% of inventory value through liquidation and discounting strategies.

Repurposing & Reusing Inventory

Not all surplus must be sold at a discount. Creative approaches can provide business value:

- Donation – Giving unsold products to charities, schools, or community groups. This not only reduces storage costs but may also provide tax deductions.

- Upcycling or repackaging – Adjusting packaging or presentation to reintroduce items to the market.

- Re-marketing – Promoting products to new customer segments or geographies.

- Employee sales/giveaways – Allowing staff to purchase or receive surplus at reduced cost.

These strategies strengthen goodwill and position the business as socially responsible while addressing the challenge of excess goods.

Financial and Accounting Actions

For inventory that cannot be sold or repurposed, businesses must address the accounting side.

- Inventory valuation adjustments – Writing down the value of stock to reflect its reduced market price.

- Write-offs – Removing obsolete inventory from the balance sheet altogether.

- Budgeting & accounting reviews – Using these adjustments to better forecast future purchasing decisions.

These practices keep financial records accurate, safeguard trust with stakeholders, and prevent inflated profitability reporting.

Preventing Surplus in the Future

The best way to handle surplus is to prevent it from accumulating in the first place. Here are long-term strategies businesses can adopt:

- Improved demand forecasting – Use data-driven methods, AI models, and historical analysis to anticipate sales.

- Lean inventory practices – Apply Just-in-Time and loss prevention techniques to minimize unnecessary stock.

- Cross-functional coordination – Align sales, marketing, and operations to reduce misaligned orders.

- Vendor collaboration – Work with suppliers on smaller, frequent orders or adopt Vendor Managed Inventory (VMI) systems.

- Regular audits & cycle counts – Spot potential overstock early before it becomes a burden.

- E-commerce fulfillment strategies – Leverage online platforms to push slow-moving products quickly through targeted promotions.

- Retail strategy adjustments – Plan for seasonality and product life cycles more carefully.

Prevention not only reduces costs but also strengthens long-term agility, allowing businesses to respond faster to market shifts.

Real-World Examples

- Castrol: Reduced finished goods inventory by 35% while improving service levels by nearly 10%.

- Electrocomponents: Increased profits by £36 million after adopting advanced forecasting and

inventory optimization.

- Fashion industry: Brands increasingly use donation and upcycling initiatives to reduce dead stock, aligning with sustainability goals.

These examples highlight how businesses can recover value, improve efficiency, and even enhance brand reputation through proactive inventory management.

Conclusion

Excess stock, whether called overstock, surplus inventory, or dead stock, is more than just a warehouse problem — it’s a financial and strategic challenge that can limit growth. Businesses that fail to manage it risk tying up capital, losing profit margins, and damaging their long-term brand strategy.

Fortunately, today’s businesses have a range of proven tools and strategies available — from liquidation and clearance sales to smarter demand forecasting and inventory management systems. By combining short-term solutions with long-term prevention, small and mid-sized businesses can protect their bottom line and turn surplus from a liability into an opportunity.

At Fast Track Liquidation, we specialize in helping businesses recover value from their unsold products and free up critical cash flow. By leveraging professional liquidation strategies, companies can move forward with confidence and focus on growth rather than excess.