How to Liquidate a Small Retail Business: A Step-by-Step Guide

July 23, 2025

Closing a retail business is never an easy decision. Whether it's due to financial strain, shifting markets, or a desire to move on to something new, liquidation can be a strategic step toward a fresh start.

But to do it right—and legally—you need a plan. In today’s economic environment, small business owners must be equipped with practical knowledge, realistic expectations, and the right mindset to carry out a smooth liquidation process.

This guide walks you through each step, offering clear advice and insights grounded in real-world experience.

Understanding Retail Liquidation in 2025

Liquidation means converting business assets—typically inventory, fixtures, and equipment—into cash to pay off debts and close the business.

In the U.S., the retail landscape has shifted dramatically in recent years. According to recent reports from Forbes, over 15,000 retail stores are expected to close in 2025. This is nearly double the number reported in 2024. Small and mid-sized retailers are among the most affected, often lacking the resources to survive long-term market disruptions.

From inflation and rising lease rates to changing consumer behavior, many store owners are choosing to wind down operations rather than continue battling increasingly competitive conditions.

When Should You Consider Liquidating Your Business?

Every business owner reaches a crossroads. But how do you know if it's time to exit?

Here are a few signs:

- Your store is consistently operating at a loss.

- You’re falling behind on debt or payroll.

- Customer traffic and sales are declining month over month.

- You no longer have the energy, interest, or capital to reinvest.

Liquidation isn’t just for businesses in trouble. Some owners choose to close because they're retiring or pivoting to ecommerce. No matter the reason, being proactive allows you to retain more value.

Step 1: Assess Your Situation and Seek Guidance

Before jumping into sales and discounts, it’s essential to review the full financial picture of your business.

Start by:

- Reviewing your current inventory and equipment

- Estimating your outstanding debts

- Understanding your lease or landlord obligations

- Listing all open contracts and vendor agreements

At this stage, consulting a certified public accountant (CPA), attorney, or business advisor can help clarify your legal responsibilities and potential tax obligations.

Even small mistakes during this phase—like breaking a lease prematurely or ignoring creditor laws—can lead to expensive consequences later.

Step 2: Notify Key Stakeholders

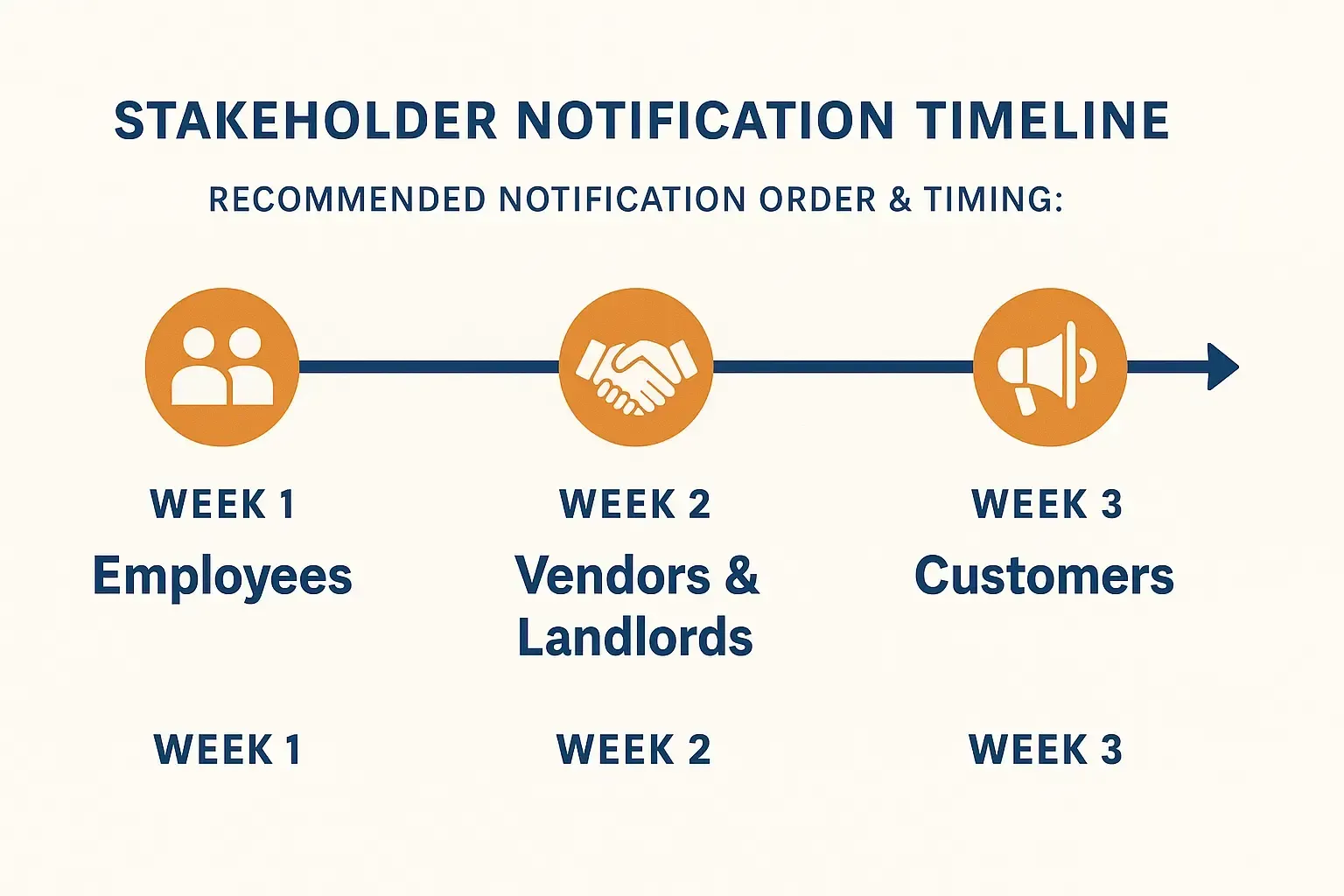

Transparency builds trust and protects your reputation. Notify your employees, landlords, and suppliers about your plan to liquidate.

If possible, give employees advance notice. Not only is this a matter of integrity, but in some states, it's also a legal requirement.

Talk with your landlord to understand any early termination fees or obligations tied to your lease. You may also want to inform loyal customers and partners. A straightforward announcement can foster goodwill and potentially lead to support during the liquidation sale.

Step 3: Plan Your Liquidation Strategy

There are several ways to liquidate inventory and assets:

- In-Store Clearance Sale: Most common and effective for small retail businesses. Start with moderate discounts (20–30%) and gradually increase them over time.

- Online Sales: List products on platforms like eBay, Facebook Marketplace, or liquidation-focused websites like B-Stock or Liquidation.com.

- Bulk Sale to Liquidators:

Sell your entire inventory at once to a liquidation company. You’ll earn less, but it’s fast and efficient.

Decide how aggressive your pricing will be based on how quickly you need to exit. Many successful store closures use a 4–6 week plan, progressively lowering prices while promoting urgency.

Be sure to include fixtures, furniture, signage, and shelving in your sale. These items often have value to other local businesses or resellers.

Step 4: Promote the Liquidation Sale

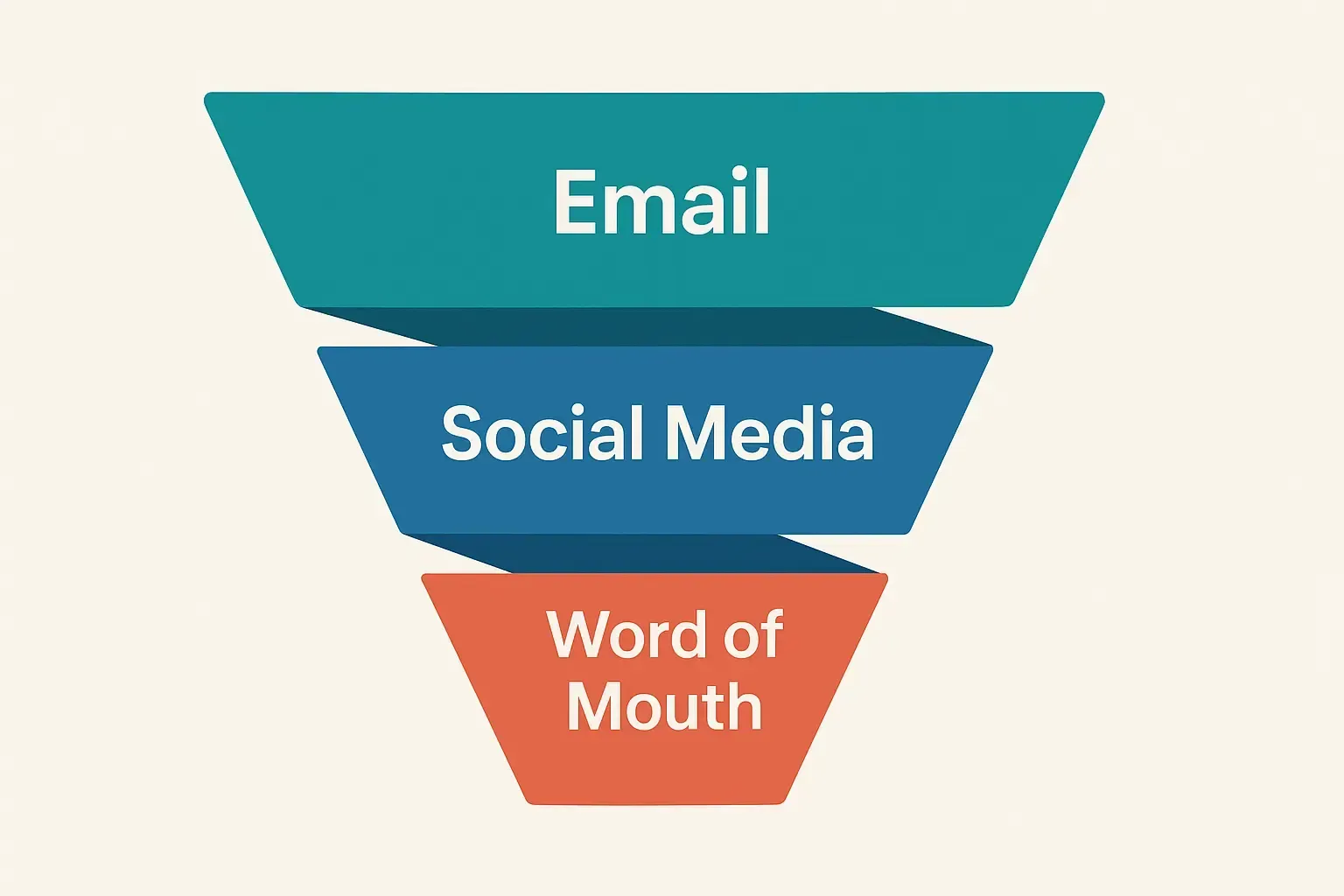

A sale is only as good as its visibility.

Start by:

- Posting large in-store signs (e.g., “Everything Must Go” or “Store Closing Sale”)

- Emailing your customer list

- Running targeted Facebook and Instagram ads

- Engaging your local community and business groups

Remember: this isn’t just a clearance sale—it’s your final brand impression. Treat it with professionalism and respect. Offer excellent customer service to the very end.

Some business owners host closing events to thank loyal customers and create a sense of community during the process.

Step 5: Track, Adjust, and Handle Leftover Inventory

During the sale, monitor your daily numbers. Adjust discounts as needed to ensure products are moving quickly.

What if some items don’t sell?

You still have options:

- Donate items to local charities and claim a tax deduction.

- Recycle or dispose of items responsibly to avoid fines.

- Sell to other business owners in your area who may need fixtures or backstock.

Staying organized here will help when it’s time to finalize your financials.

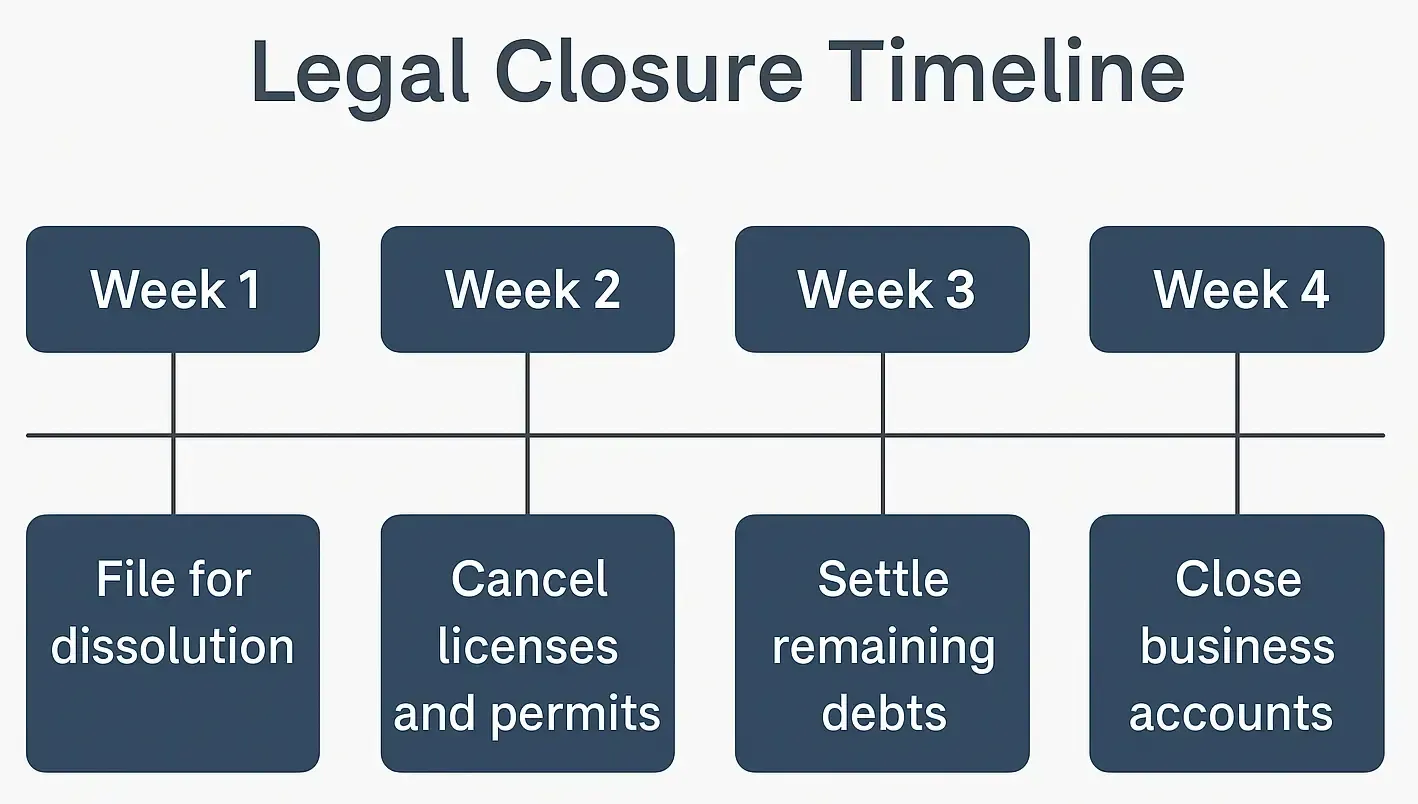

Step 6: Close Out Financial and Legal Obligations

Once your sale is complete, take care of the remaining back-end tasks:

- Cancel your business license and permits

- File Articles of Dissolution with your state

- File final federal and state tax returns

- Close your business bank account

- Notify the IRS and local tax agencies

Keep all records—sales receipts, tax filings, dissolution documents—for at least 3–7 years.

It’s also a good time to consult your CPA about potential capital gains or write-offs related to unsold inventory or dissolved assets.

Common Mistakes to Avoid

- Waiting too long to act: The longer you delay, the less control you’ll have.

- Poor planning: Rushed sales can lead to lost profits and damaged reputations.

- Ignoring legal steps: Missed filings can result in fines and tax penalties.

Cutting corners on promotion: If no one knows about your sale, it won’t matter how steep your discounts are.

Take the time to do it right. Your business—and your future self—will thank you.

Life After Liquidation: What’s Next?

Liquidating your business doesn’t mean you’ve failed. It means you’ve made a strategic decision.

Many business owners move on to start ecommerce shops, consult in their industry, or take time to reset. The lessons you’ve learned in retail—customer service, product management, marketing—are highly transferable.

Use your liquidation as a stepping stone, not a stopping point.

Conclusion: Let Fast Track Liquidation Help You Do It Right

If you’re considering closing your small retail business, you don’t have to do it alone.

Fast Track Liquidation is dedicated to helping small and mid-sized business owners like you take control of the process—with clarity, professionalism, and dignity. From resources and strategies to real-world insights, we aim to support you every step of the way.

Because liquidation isn’t just about selling off products—it’s about closing one chapter with confidence and preparing for the next.