How to Liquidate Inventory: A Complete Guide for U.S. Business Owners

May 28, 2025

Managing inventory effectively is crucial for any business. But when products no longer move or take up valuable space, liquidation becomes the most practical solution. Liquidating inventory means converting excess or obsolete stock into cash or clearing it from storage efficiently. Done right, it can protect your bottom line, streamline operations, and create opportunities for fresh inventory.

According to a report by Supply Chain Quarterly, up to 30% of a retailer's inventory may be excess or obsolete. That’s a significant amount of capital locked in storage. This guide will walk you through when and how to liquidate inventory, offering practical strategies tailored for U.S. businesses.

When Should You Consider Liquidating Inventory?

There are a variety of reasons why businesses might need to liquidate inventory. Recognizing these triggers early can help prevent major losses.

Below is a table highlighting common liquidation triggers along with real-world industry examples:

| Trigger | Description | Commonly Affected Industries |

|---|---|---|

| Overstocked Products | Surplus due to inaccurate demand forecasting or bulk purchasing | Electronics, Furniture, Grocery Retail |

| Seasonal Items That Didn’t Sell | Leftover stock tied to specific seasons or holidays | Apparel, Home Décor, Sporting Goods |

| Discontinued or Outdated Products | Items phased out due to new versions or trends | Consumer Electronics, Toys, Auto Parts |

| Returned Items (Not Resellable) | Customer returns that can't be sold as new | Fashion, Small Appliances, Accessories |

| Business Restructuring or Closure | Company downsizing or shutting down operations | All sectors, especially Retail & Wholesale |

These signs often indicate it’s time to take action. Delaying can lead to deeper losses, increased holding costs, and reduced warehouse efficiency.

If you’re experiencing rising storage fees or stagnant turnover, liquidating could be the key to restoring both profitability and operational space.

Step-by-Step Guide to Liquidating Inventory

1. Audit and Categorize Your Inventory

Start by taking a thorough look at what’s sitting unsold. Use inventory management software to generate reports or conduct a manual audit. Be honest and precise—underestimating dead stock only delays decision-making.

- Separate inventory into three buckets: slow-moving, dead stock, and seasonal leftovers.

- Identify items with the highest carrying costs.

- Determine storage duration and expiration risks.

2. Set Clear Objectives

Before jumping into selling, define your purpose. Are you looking to free up warehouse space, recover cash quickly, or reposition your brand? Knowing your goal will shape the liquidation method you choose and influence pricing.

- Speed vs. Profit: Do you need fast removal or higher returns?

- Channel Visibility: Are you okay with public sales or prefer private channels?

3. Choose Your Liquidation Strategy

There’s no one-size-fits-all solution. Evaluate different channels and weigh the pros and cons based on your goals, resources, and brand considerations.

Top Strategies to Liquidate Inventory in the U.S.

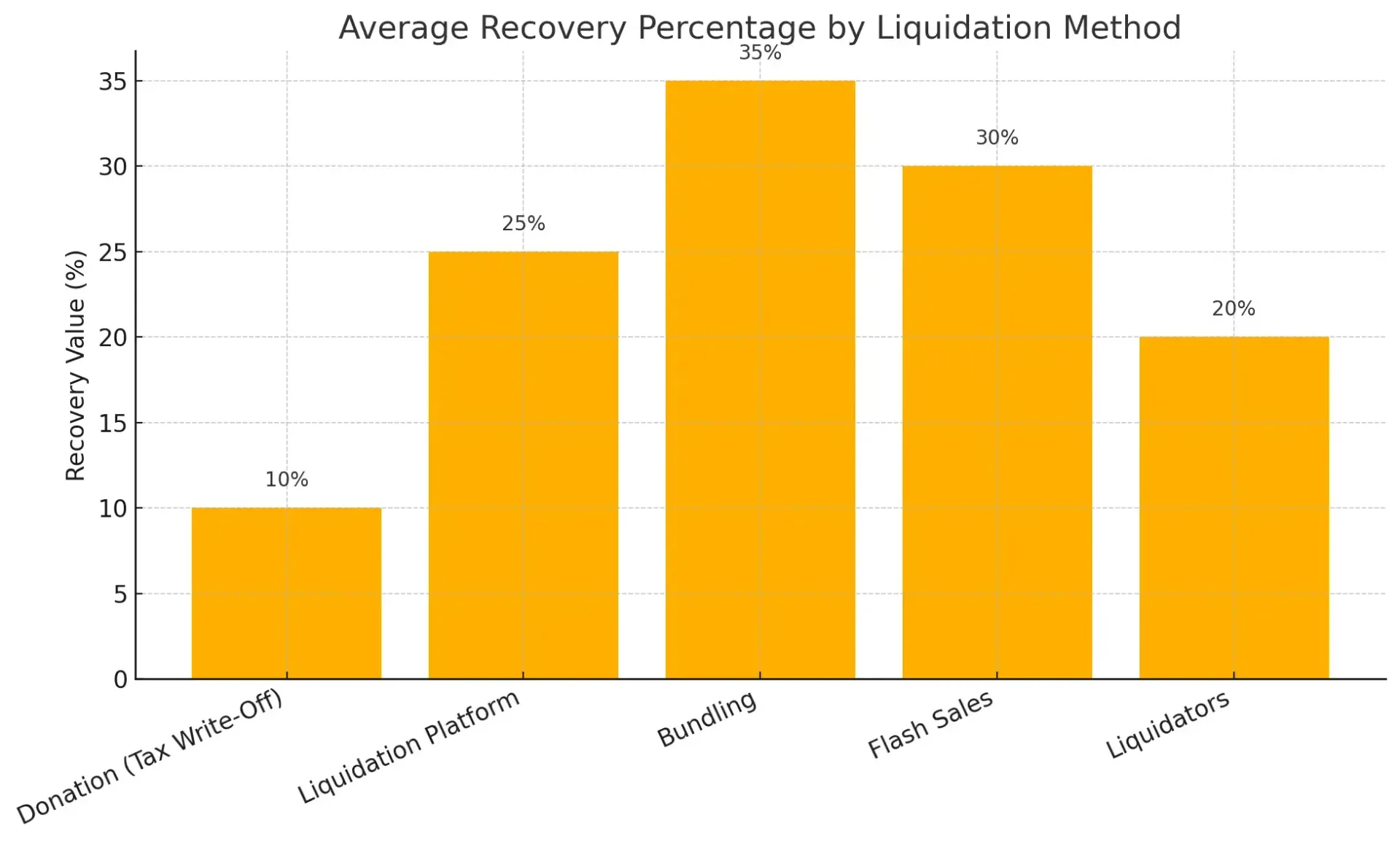

1. Offer Bulk Discounts and Flash Sales

Create urgency with time-limited offers. Use email marketing, social media, and website banners to promote the event.

- Example: "Buy 3, get 2 free" or "Flash Sale: 60% off clearance items."

- Highlight scarcity: “Only 50 units left!” to push urgency.

These sales appeal to loyal customers and bargain seekers. Segment your audience and personalize messages for best results.

2. Bundle Products

Combining slow-selling items with high-demand ones creates perceived value.

- Example: Pair winter accessories with coats or electronics with accessories.

- This strategy works well in ecommerce and brick-and-mortar.

3. List on Liquidation Marketplaces

Top U.S. platforms include:

- B-Stock – for B2B liquidation with buyer competition

- Liquidation.com – wide range of consumer goods

- Bulq – curated lots for resellers

Pro Tip: Compare fees, customer reach, and return policies. Evaluate the type of buyers each platform attracts to match your product niche.

4. Work with Liquidators and Resellers

Many U.S. businesses specialize in buying inventory in bulk. While your margins may be lower, it’s fast and efficient.

- Vet liquidators thoroughly—look for BBB accreditation, reviews, and payment terms.

- Consider local buyers for faster logistics.

5. Donate for a Tax Write-Off

Donating unsold stock can be a win-win. It helps communities and may qualify for tax deductions under IRS Section 170(e)(3).

- Partner with non-profits, schools, or disaster relief organizations.

- Ensure you receive proper documentation for tax filings.

6. Recycle or Repurpose Unsellable Goods

If items are damaged or expired, look into recycling programs or break them down for parts.

- Electronics can be salvaged for components.

- Apparel can be donated for textile reuse.

This helps reduce environmental waste and supports sustainability initiatives.

How to Price Liquidated Inventory

Pricing is often the trickiest part of liquidation. Set prices too high, and products remain stuck. Set them too low, and you lose potential returns.

- Tiered Discounts: Start with 30% off, increasing over time.

- Dynamic Pricing Tools: Use platforms like Prisync or Sellery to automate markdowns.

Liquidated inventory is typically marked down 40% to 70% off original retail.

According to Investopedia, retailers recover just 15% to 30% of original value during liquidation. It’s better to recover some capital than none at all.

Don’t forget hidden costs: shipping, platform fees, employee time, and transaction fees should all be factored into your final net profit.

Common Mistakes to Avoid

- Waiting too long – Delays mean further depreciation and missed opportunities.

- No ROI tracking – Always measure what works to refine future strategies.

- Hurting brand image – Use separate clearance channels or marketplaces to maintain brand integrity.

- Ignoring contract terms – Read the fine print when working with third parties, including return rights and payout windows.

- Overcomplicating the process – Keep workflows simple and staff aligned to avoid operational hiccups.

Real-Life Example: Fashion Retailer Liquidation

A mid-sized apparel company in Texas faced a warehouse packed with unsold winter coats in March. By bundling items, running a 72-hour flash sale, and listing on B-Stock, they recovered 40% of their cost within two weeks.

In another case, a tech accessories business in California partnered with a local liquidator. The company sold 1,000 units of discontinued chargers in three days, saving on warehousing costs and freeing up funds for a new product line. These examples highlight that well-executed liquidation strategies can deliver fast, measurable results.

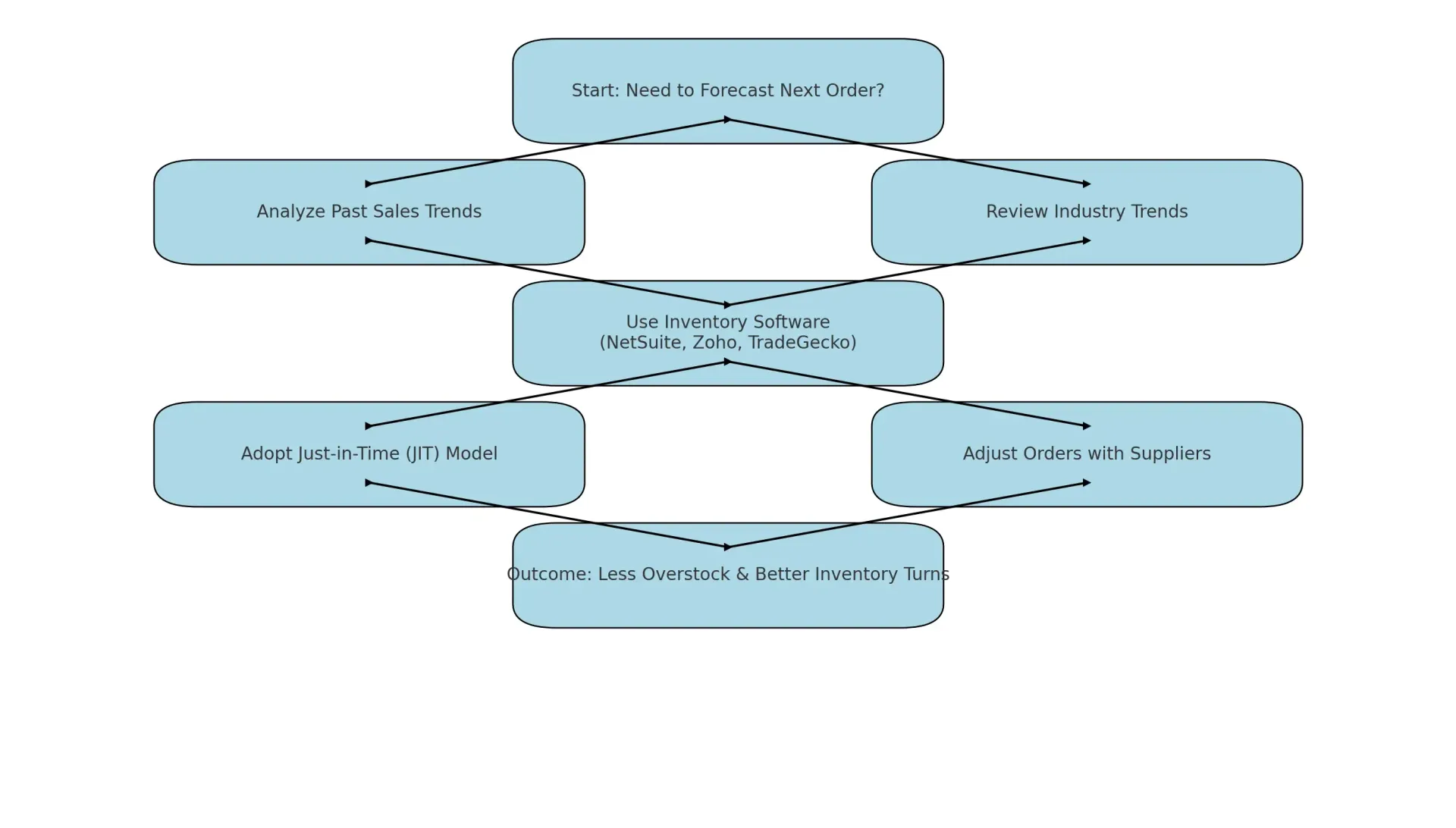

Liquidation is a safety net, but prevention is ideal. Here’s how to avoid repeating the same cycle:

- Forecast demand more accurately using past sales and industry trends.

- Use inventory management software like NetSuite, Zoho Inventory, or TradeGecko.

- Adopt a just-in-time (JIT) model where appropriate to reduce holding costs.

- Collaborate closely with suppliers to adjust orders based on demand fluctuations.

Gartner research shows that businesses using predictive analytics reduced excess stock by 20–30% and increased order fulfillment rates. Leveraging technology is no longer optional—it's essential to staying competitive.

Also, train staff in inventory handling and update your SKU database regularly. A clean system ensures better tracking and fewer ordering errors.

Bonus: Liquidation Checklist for Business Owners

- ✅ Conduct full inventory audit

- ✅ Set clear liquidation goals

- ✅ Choose the right combination of liquidation methods

- ✅ Calculate expected ROI and pricing strategy

- ✅ Track results and adjust strategy accordingly

- ✅ Learn and implement measures to avoid overstock in future

Print this checklist and refer to it each quarter to stay on track.

Conclusion

Inventory liquidation isn’t just about getting rid of unsold goods—it’s a strategic move to reclaim capital, reduce losses, and reset your operations. For U.S. businesses, choosing the right method can mean the difference between loss and opportunity. Whether you're trying to clear seasonal stock or reset after a business shift, timing and execution are everything.

Fast Track Liquidation helps businesses do exactly that—liquidate smarter, restart faster. With proven systems, reliable partnerships, and a focus on honest service, Fast Track Liquidation is the trusted ally of small and mid-sized businesses across the U.S.

When it’s time to let go of excess inventory, don’t just liquidate—liquidate with confidence.

Let Fast Track Liquidation put your business back in motion.