What Is a Liquidation Sale?

June 28, 2025

A

liquidation sale is more than just slashed prices and “everything must go” signs. It’s a strategic process used by businesses to convert assets into cash—often under urgent circumstances. Whether it’s a small retailer closing shop or a national chain restructuring, liquidation sales represent a critical phase in the business lifecycle.

For consumers, these sales can be an opportunity to buy products at steep discounts. For business owners, liquidation can be a way to recover value before a shutdown or transition. Understanding how these sales work—and why they happen—helps clarify the business decisions behind them.

Understanding the Basics

A liquidation sale occurs when a business decides (or is forced) to sell off its inventory and sometimes equipment, fixtures, and other assets. These sales are typically prompted by:

- Bankruptcy

- Business closure

- Downsizing or relocation

- Overstocked or returned inventory

What sets liquidation apart from standard clearance sales is urgency. These are not just end-of-season markdowns. Liquidation sales are typically final, with all items sold “as-is” and with limited or no return policies.

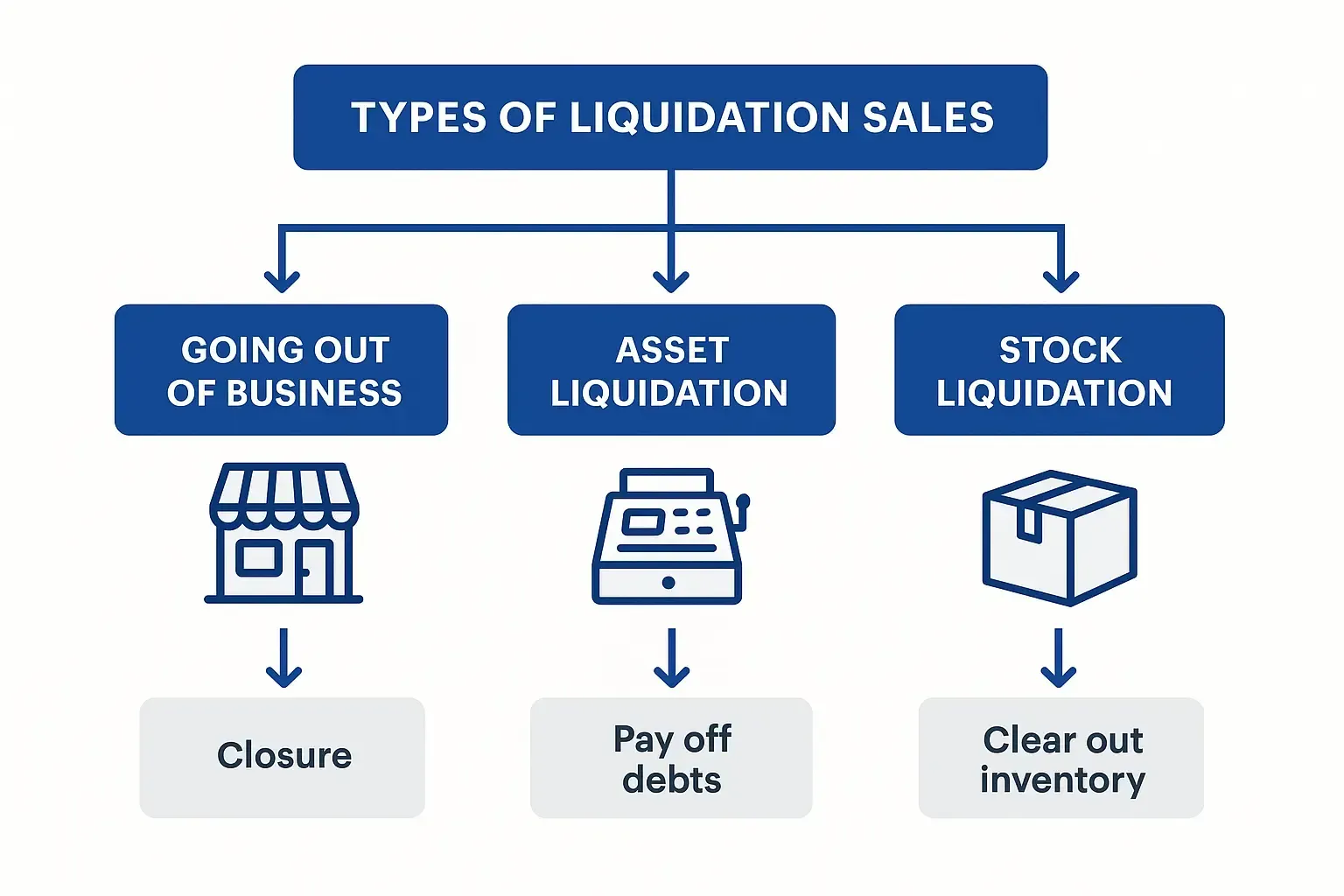

Types of Liquidation Sales

Not all liquidation sales are the same. Each type has its own triggers and goals:

Going-Out-of-Business Liquidation

This is the most recognizable type. A company is shutting down permanently and must sell off everything—inventory, shelving, signage, and sometimes even real estate.

Bankruptcy Liquidation

When a company files for Chapter 7 bankruptcy, a court-appointed trustee is responsible for selling assets to repay creditors. Prices in these cases are usually steeply discounted, and the process is closely regulated.

Voluntary Liquidation

Sometimes, business owners choose to shut down and liquidate despite being financially solvent. This often occurs during retirement or when pivoting to another venture.

Online Liquidation

With the rise of e-commerce, platforms like Amazon, B-Stock, and Liquidation.com now facilitate online liquidation sales. Products may include overstock, returns, or excess inventory from third-party sellers.

According to

Statista, U.S. returns and overstock merchandise are expected to surpass $700 billion in value by 2025—a large portion of which enters the liquidation pipeline.

The Liquidation Process

Most liquidation sales follow a structured process:

- Inventory Assessment – Businesses evaluate which products and assets will be liquidated.

- Pricing Strategy – Discounts are applied, often starting at 20–30% off and increasing over time.

- Marketing the Sale – Announcements are made online, in-store, and via email.

- Executing the Sale – The business may handle it internally or hire professional liquidators.

- Settlement of Debts – Proceeds from the sale are used to repay creditors, lease obligations, or reinvest.

Professional liquidators often manage large-scale operations, especially in bankruptcy cases, ensuring compliance with financial regulations.

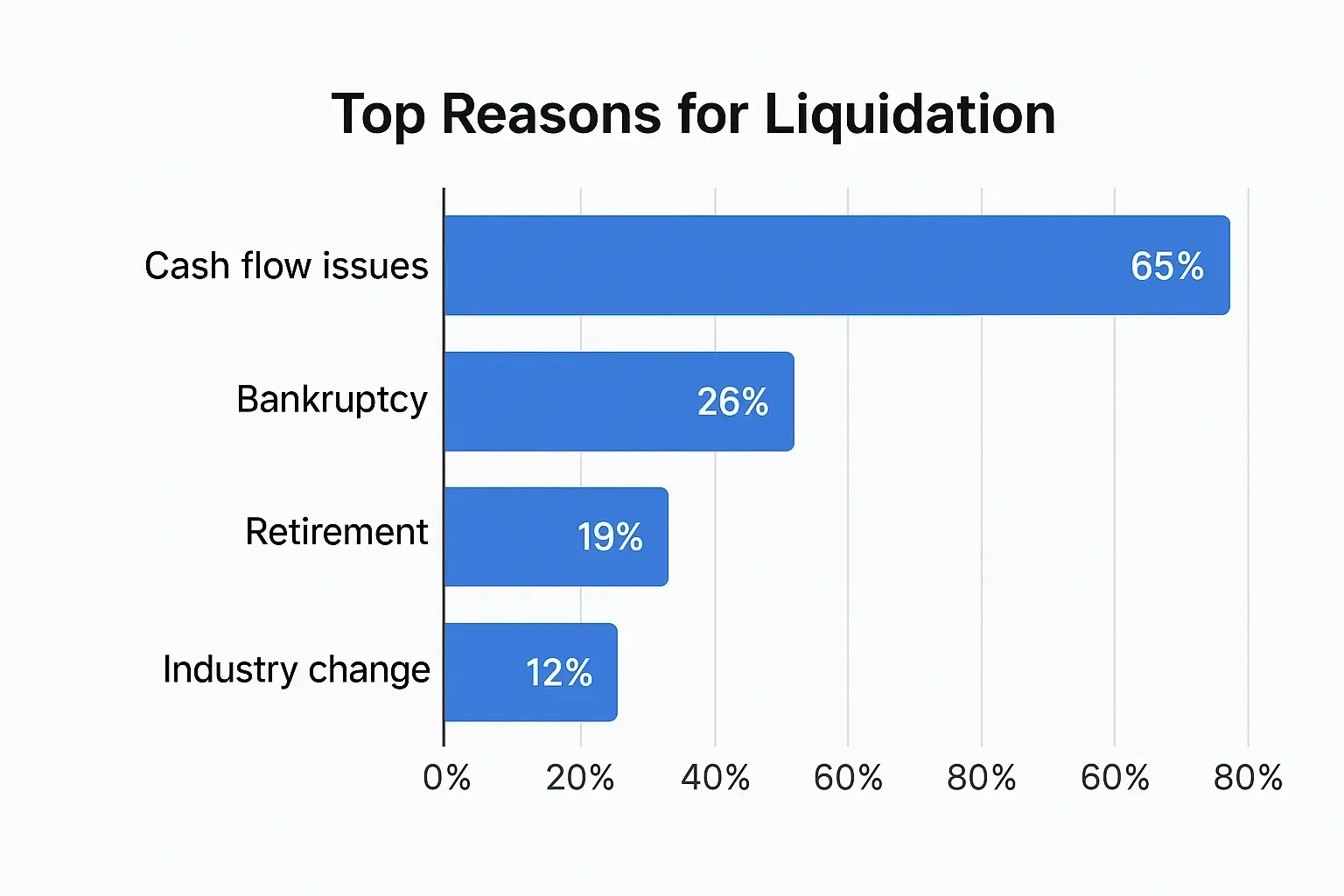

Why Businesses Liquidate

Liquidation isn't always a signal of failure. It can be a practical and sometimes profitable decision. Reasons include:

- Cash flow problems

- Market shifts or declining demand

- Overleveraged operations

- Strategic rebranding or restructuring

For instance, when Bed Bath & Beyond liquidated its assets in 2023, it was part of a larger restructuring plan after declaring bankruptcy. More than 300 stores were shut down, and inventory was sold at up to 70% off retail prices.

What It Means for Consumers

Shoppers are drawn to liquidation sales for the potential savings. But they should also understand the limitations:

- Most sales are

final—no returns or exchanges.

- Warranties may be void or non-transferable.

- Product

availability is often limited and unpredictable.

That said, with careful attention and quick action, consumers can find excellent deals—especially on electronics, furniture, and bulk merchandise.

Liquidation vs Clearance: Know the Difference

| Feature | Liquidation Sale | Clearance Sale |

|---|---|---|

| Purpose | Business closure or asset recovery | Seasonal inventory rotation |

| Urgency | High | Moderate |

| Returns Allowed? | Rarely | Often Yes |

| Product Condition | Mixed (new, returned, excess) | Typically New |

| Discounts | 30% to 90% off | 10% to 50% off |

Tips for Buying from a Liquidation Sale

- Inspect products carefully before purchase.

- Act quickly, especially on high-demand items.

- Understand the terms—many sales are cash-only or have special return policies.

- Verify legitimacy, especially online. Stick with platforms like Direct Liquidation, B-Stock, or Amazon Liquidation Auctions.

Final Thoughts

A liquidation sale can serve many purposes—salvaging value, satisfying creditors, or offering consumers deep discounts. But at its core, it reflects a key business principle: when change is inevitable, value must be preserved in some form.

For business owners navigating liquidation, or for resellers looking to purchase profitable inventory, knowledge is power. Knowing how these sales operate is essential in making sound financial decisions.

At Fast Track Liquidation, we help bridge this gap by offering guidance, resources, and trusted services to help you navigate liquidation confidently—whether you're selling inventory or buying it. With industry expertise and a focus on transparency, our mission is to make liquidation work for your business goals.