Liquidate Meaning in Business: What Every Business Owner Should Know

May 31, 2025

In the world of business, few terms carry as much weight as "liquidate." For many, it's associated with finality—the end of operations. But liquidation is not always a story of failure. Sometimes, it's a strategic decision. Whether you're a seasoned entrepreneur or a small business owner facing financial hurdles, understanding what liquidation means can help you make informed, confident decisions.

This guide breaks down the concept of liquidation in business, explores different types, shares recent statistics, and helps you navigate this complex process with clarity and confidence.

What Does Liquidate Mean in Business?

To liquidate in business means converting assets—such as inventory, equipment, or property—into cash. This process typically happens when a company is closing down, paying off debts, or restructuring. In simpler terms, it's about turning what a business owns into money, either to pay creditors or to distribute assets among stakeholders.

But liquidation isn’t just about closing shop. It can also be used to clear obsolete inventory, streamline operations, or pivot a business model.

For example, many ecommerce businesses liquidate old stock through flash sales or third-party liquidation marketplaces. In those cases, liquidation serves as a reset rather than a shutdown.

Different Types of Business Liquidation

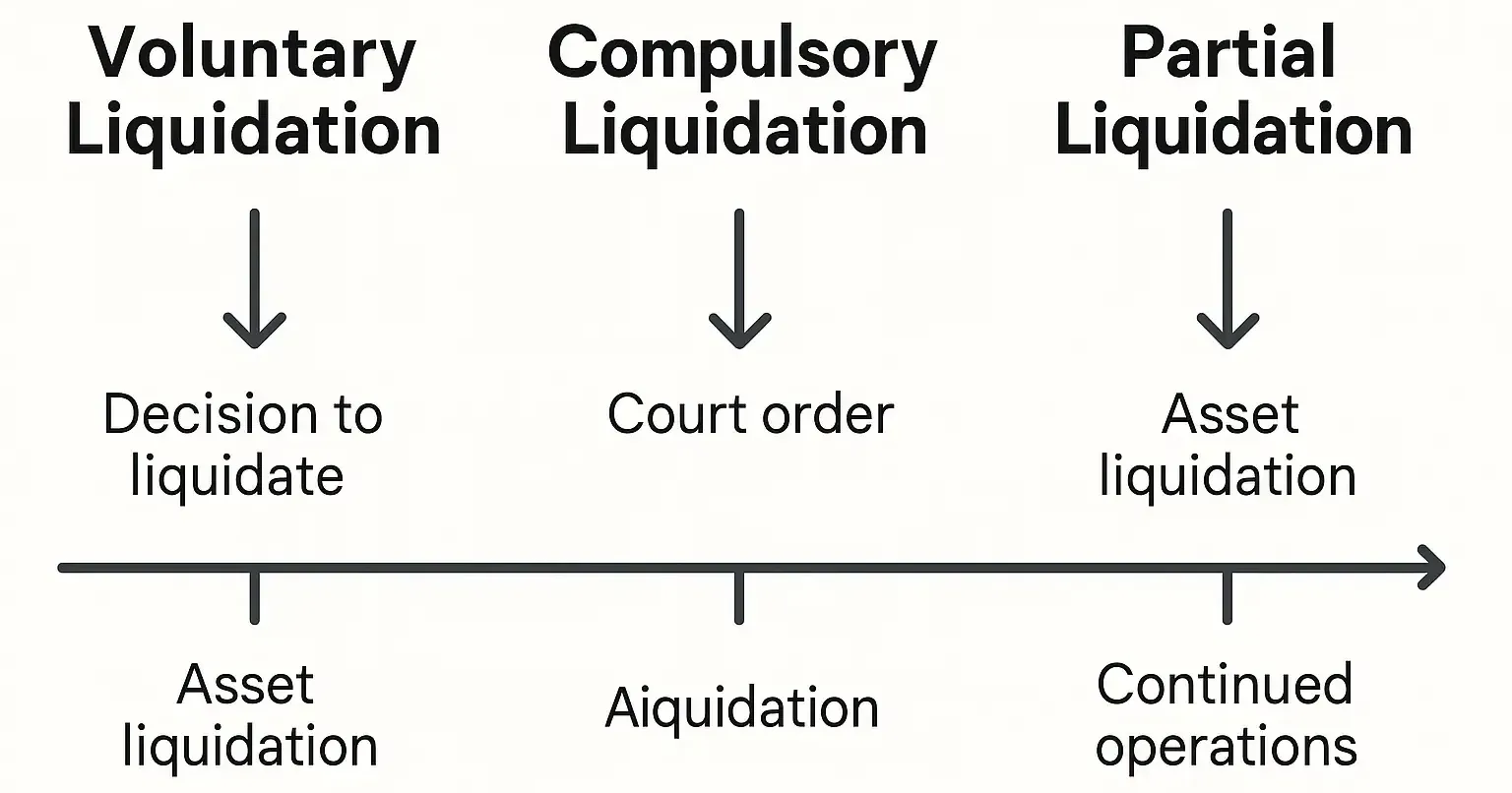

There are three main types of liquidation. Each one applies to a different situation:

1. Voluntary Liquidation

This occurs when the company's leadership decides to close the business. It's often done to settle debts, distribute assets, or exit the market on good terms.

Members' Voluntary Liquidation (MVL): Used when the business is solvent. All debts are paid, and remaining assets go to shareholders.

Creditors' Voluntary Liquidation (CVL): Used when the business is insolvent. Creditors are paid in order of priority based on asset sales.

2. Compulsory Liquidation

In this case, a court orders the company to shut down, usually because creditors have filed a petition. A liquidator is appointed to sell assets and repay debts.

3. Partial Liquidation

Sometimes, businesses liquidate only part of their assets to stay afloat. This might include selling off underperforming divisions or surplus inventory.

Each type has distinct legal and financial implications. For business owners, knowing which path to take depends on solvency, debt structure, and long-term goals.

When Do Businesses Choose to Liquidate?

There are multiple reasons why a business might opt for liquidation:

- Insolvency: When a business can no longer meet its financial obligations.

- Strategic Exit: Owners may want to retire or pursue new ventures.

- Debt Pressure: Liquidation can help pay off mounting debts and reduce financial exposure.

- Market Shifts: Economic changes or industry disruptions may force businesses to close.

- Inventory Overload: Companies may liquidate excess stock to avoid storage costs or write-downs.

Understanding these triggers helps business owners evaluate whether liquidation is a last resort or a practical decision.

The Liquidation Process: Step-by-Step

Navigating a liquidation is a multi-step process. Here’s a simplified breakdown:

- Financial Assessment

Evaluate current debts, assets, and overall financial health. This step often involves accountants or legal advisors. - Appoint a Liquidator

A licensed insolvency professional or liquidation specialist is appointed to oversee the process. - Asset Valuation and Sale

All business assets are appraised and sold. This may include equipment, inventory, intellectual property, and real estate. - Creditor Repayment

The proceeds are used to repay creditors based on legal priority—secured creditors, unsecured creditors, and then shareholders (if anything remains). - Company Dissolution

Once assets are sold and debts settled, the business is formally dissolved with government authorities.

Each stage must be handled with care to avoid legal complications or disputes among stakeholders.

Recent Liquidation Trends in the U.S.

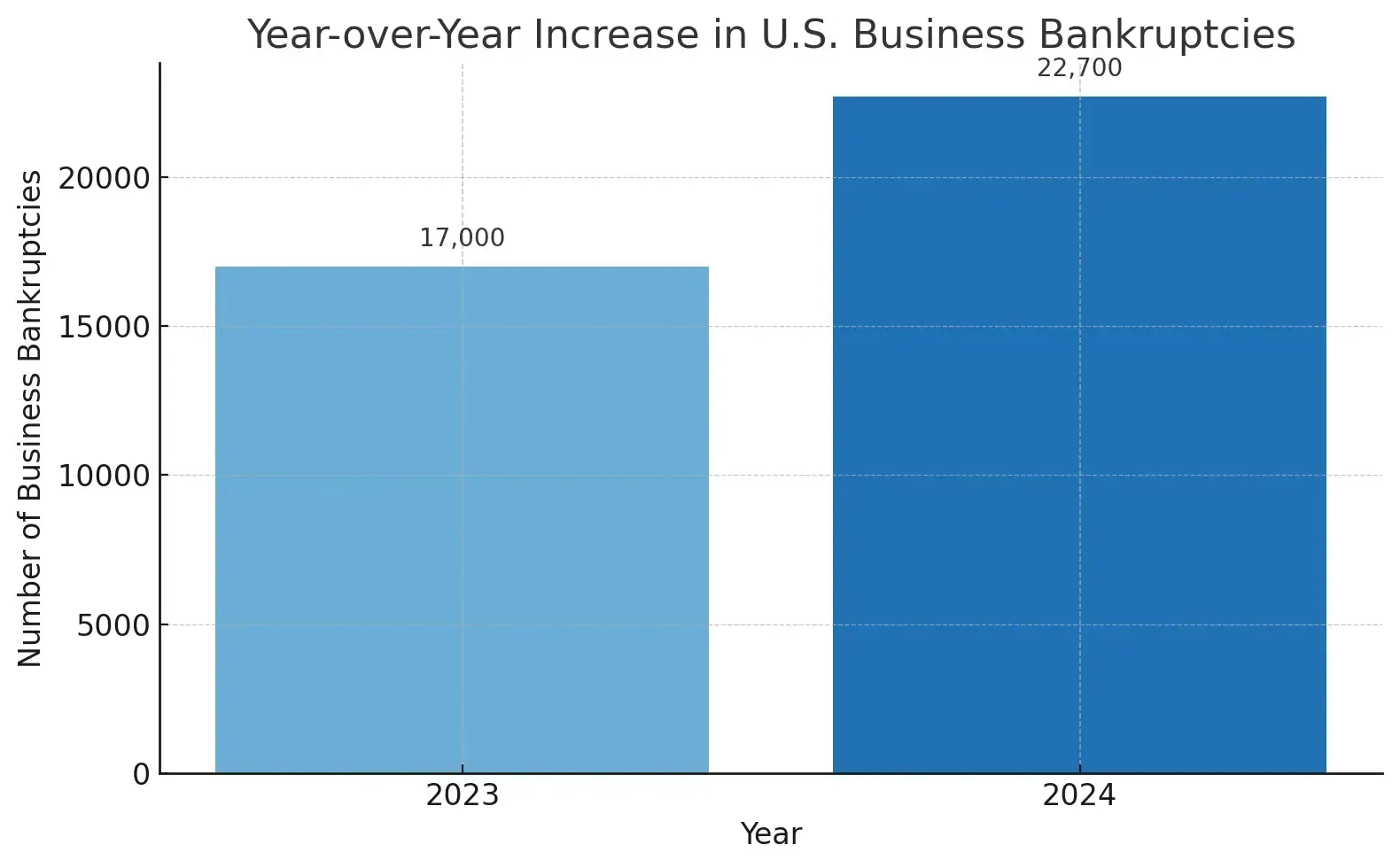

Business liquidation isn't rare. In fact, it's on the rise due to inflation, higher interest rates, and post-pandemic market shifts.

According to data from the Administrative Office of the U.S. Courts, total business bankruptcy filings rose by 33.5% in 2024. Over 22,700 business bankruptcies were filed in just one year. Many of these resulted in liquidation.

Industries such as retail, manufacturing, and tech have seen increased closures. Supply chain issues and consumer spending changes were major drivers.

These trends suggest that even established companies are vulnerable. For small-to-mid-sized businesses, preparation and awareness are key.

Examples of Notable Business Liquidations

Real-world cases provide important context:

- Big Lots (2024): Announced closure of all remaining stores following Chapter 11 bankruptcy.

- HEI Schools Australia (2025): Liquidated after owing millions to staff and creditors.

- Liberty Steel UK (2025): Facing potential liquidation after accumulating significant losses.

These cases show how operational challenges, economic shifts, or management issues can lead to liquidation—regardless of company size or industry.

What Happens After Liquidation?

The aftermath of liquidation varies depending on the situation:

- Creditors: May recover part of their loans, but unsecured creditors often receive less.

- Employees: Are typically laid off but may be entitled to benefits or severance.

- Owners: May receive leftover proceeds (in solvent cases) or face potential legal consequences (in insolvent cases).

Proper planning and professional guidance can help soften the impact and protect business reputation.

Are There Alternatives to Liquidation?

Yes. Not every financial issue leads to liquidation. Here are some options:

- Restructuring: Adjusting operations, renegotiating contracts, or downsizing.

- Mergers or Acquisitions: Selling the company to another firm.

- Debt Settlement: Negotiating new terms with creditors.

- Company Voluntary Arrangements (CVAs): A formal agreement to repay debts over time.

Exploring these options can keep a business alive and protect its value.

Conclusion: Navigating Liquidation with Confidence

Liquidation is a powerful tool—not just for ending a business, but for restarting with less burden or making strategic shifts. By understanding what liquidation truly means and how it applies in real-world scenarios, business owners can protect their interests and plan more effectively.

At Fast Track Liquidation, we specialize in helping businesses transition with clarity and confidence. Whether you're clearing out inventory or facing more serious financial decisions, we provide support every step of the way.

Follow our articles to stay informed on liquidation strategies, industry trends, and business recovery insights tailored for U.S. entrepreneurs.