Is Liquidation Good or Bad? A Comprehensive Guide for Business Owners

June 22, 2025

Liquidation is often seen as a sign of failure, but it's a complex legal process with both risks and opportunities. As an experienced e-commerce entrepreneur, I know it’s not always a negative path—it depends on your strategy and situation. This guide breaks down the realities of business liquidation for small to mid-sized U.S. business owners, offering clear insights, legal context, and real-world examples to help you make informed decisions.

The Upside of Liquidation: When It Can Be a Strategic Advantage

Despite its frequently negative connotation, liquidation can, in specific scenarios, offer significant advantages. It provides a structured and legal pathway forward, allowing for resolution and, sometimes, even a strategic reorientation.

Business Liquidation: A Smart Move for Directors

When facing financial challenges, business liquidation offers directors a clear path forward. This structured process provides crucial benefits:

- Avoid Personal Liability: Protects directors from personal responsibility for company debts.

- Legal & Organized Closure: Ensures a formal, legal end to the business, resolving all obligations efficiently.

- Relieve Creditor Stress: A trustee handles all creditor communications, freeing directors from daily pressure.

- Pave the Way for New Ventures: Allows a responsible exit, potentially leading to fresh business opportunities.

- Maximize Shareholder Returns: For solvent businesses, it can be a tax-efficient way to distribute assets.

Choosing liquidation means a controlled wind-down, offering both legal protection and a chance for a new start.

For Creditors: Ensuring Fairness and Recovery

From a creditor's perspective, liquidation, particularly through Chapter 7 bankruptcy, provides a mechanism for the fair and equitable distribution of assets. Any available assets are sold, and the proceeds are distributed among creditors according to a legally defined hierarchy established by the U.S. Bankruptcy Code. This structured approach, overseen by an impartial trustee, promotes fairness and prevents individual creditors from disproportionately seizing assets, ensuring a level playing field for all.

The process also offers transparency and accountability. The involvement of a court-appointed trustee ensures that the asset realization and distribution process is conducted openly and in compliance with federal law. Creditors have the right to receive information and participate in the process, providing them with confidence that their claims are being managed impartially.

For the Broader U.S. Economy: Promoting Market Health

From an economic perspective, liquidation isn't just about individual business failures; it contributes to the overall health of the market. It represents the reallocation of resources from unproductive or failing ventures to potentially more efficient and innovative uses. This "creative destruction" is a vital aspect of a dynamic capitalist economy, allowing capital, labor, and assets to flow to more promising opportunities where they can generate greater value. Think of it as pruning a garden to allow healthier plants to flourish.

Furthermore, liquidation contributes to market stability and a "cleansing effect." By providing a definitive mechanism for removing inefficient or unsustainable firms, it prevents "zombie companies"—businesses that are technically insolvent but continue to operate, often tying up valuable resources—from prolonging their drain on the economy. While sometimes delayed, this process ultimately enhances market competitiveness and ensures that capital is deployed more productively. It's a necessary aspect of a self-correcting market.

The Downside of Liquidation: Understanding the Challenges

Despite its potential for providing a clear resolution, liquidation often comes with significant drawbacks and challenges that U.S. business owners must fully comprehend.

Business Liquidation: Risks for Directors

While sometimes necessary, business liquidation brings significant challenges for directors and the company:

- Loss of the Business: The company ceases to exist, a deep personal loss for founders.

- Loss of Control: Directors hand over full control of assets to a liquidator or trustee.

- Reputational Damage: Liquidation can harm directors' and shareholders' public and professional standing, affecting future ventures.

- Significant Costs: The process incurs substantial fees for attorneys and trustees, reducing funds for creditors.

- Director Conduct Investigation: Trustees scrutinize past financial actions, potentially leading to personal liability for directors.

- Personal Guarantee Invocation: Directors may become personally responsible for company debts if they provided guarantees.

Understanding these profound consequences is vital when considering business dissolution.

For Employees: Job Insecurity and Disruption

One of the most direct and painful impacts of a business liquidation is the widespread redundancy and job loss for employees. Operations cease, leading to immediate unemployment for the entire workforce. This results in significant economic uncertainty for individuals and their families.

Beyond individual jobs, the liquidation process often leads to the loss of established teams and organizational synergy. The collective expertise and culture built over years dissipate, impacting the broader professional landscape. While employees in the U.S. may be eligible for certain benefits like unemployment insurance and, in some cases, payments for unpaid wages or severance through programs like the Wage Earner Protection Program (WEPP) if their employer filed for bankruptcy, the overall disruption to careers and livelihoods is profound. Employees typically become unsecured creditors for these claims, meaning their recovery depends on the assets available.

For Creditors: Incomplete Recovery and Delays

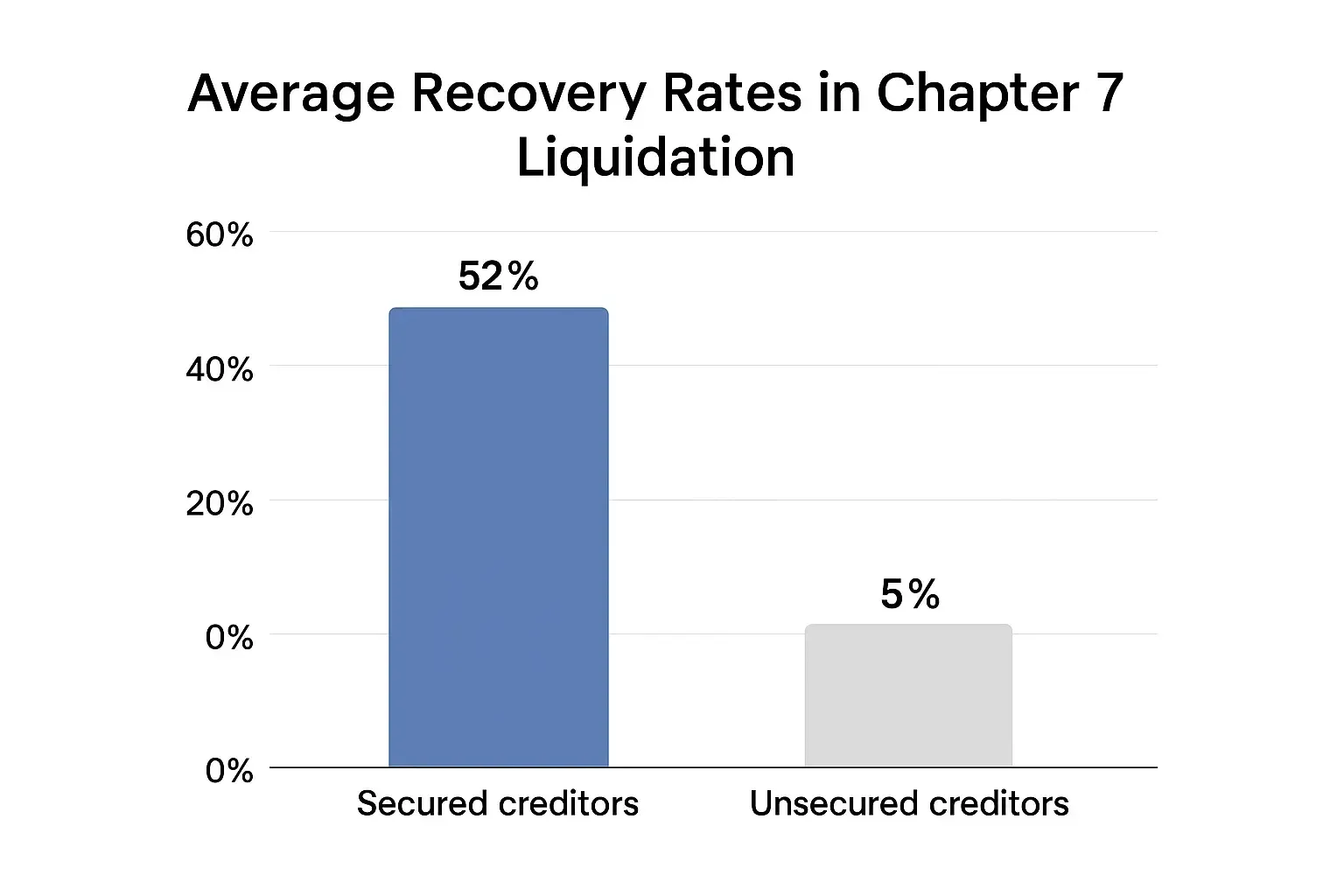

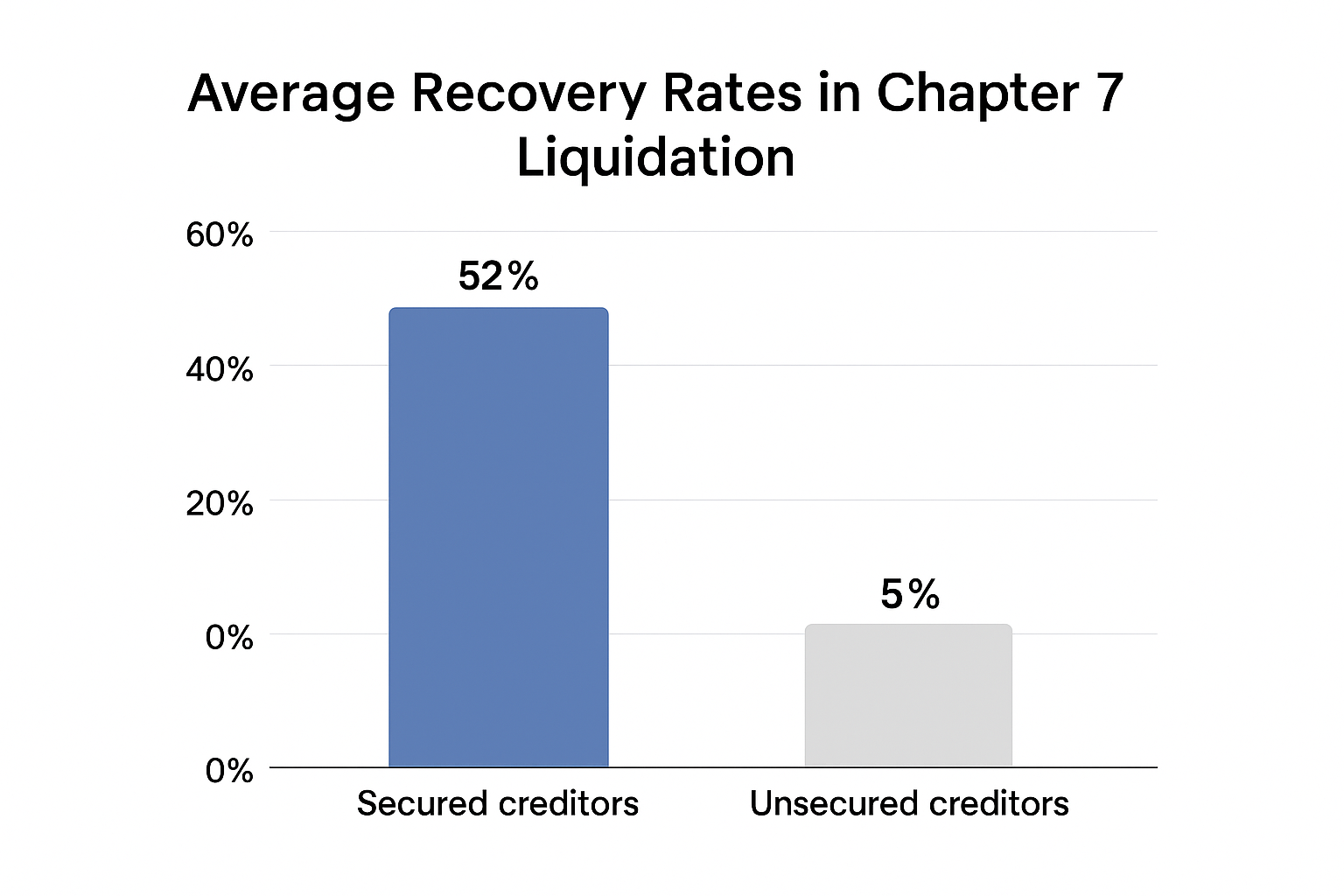

Despite the structured nature of liquidation, it is a harsh reality that in many insolvencies, there are simply not enough assets to fully repay all creditors. This often leads to partial or no recovery of debts for suppliers, lenders, and other parties. Recovery rates for unsecured creditors in Chapter 7 liquidations can vary widely but are often low, reflecting the limited assets typically available when a business reaches this stage. Studies on corporate defaults show that recovery rates for unsecured debt can be significantly lower than for secured debt.

Furthermore, the liquidation process can be time-consuming. It often takes months or even years to conclude, particularly for larger or more complex cases involving diverse assets or numerous creditors. This delay means that creditors may wait a significant amount of time before receiving any distribution, adding to their financial strain.

Navigating the Types of Liquidation: Understanding the Differences

In the U.S., the term "liquidation" is most commonly associated with Chapter 7 bankruptcy, which specifically handles the liquidation of assets to pay creditors. However, it's helpful to understand the broader context.

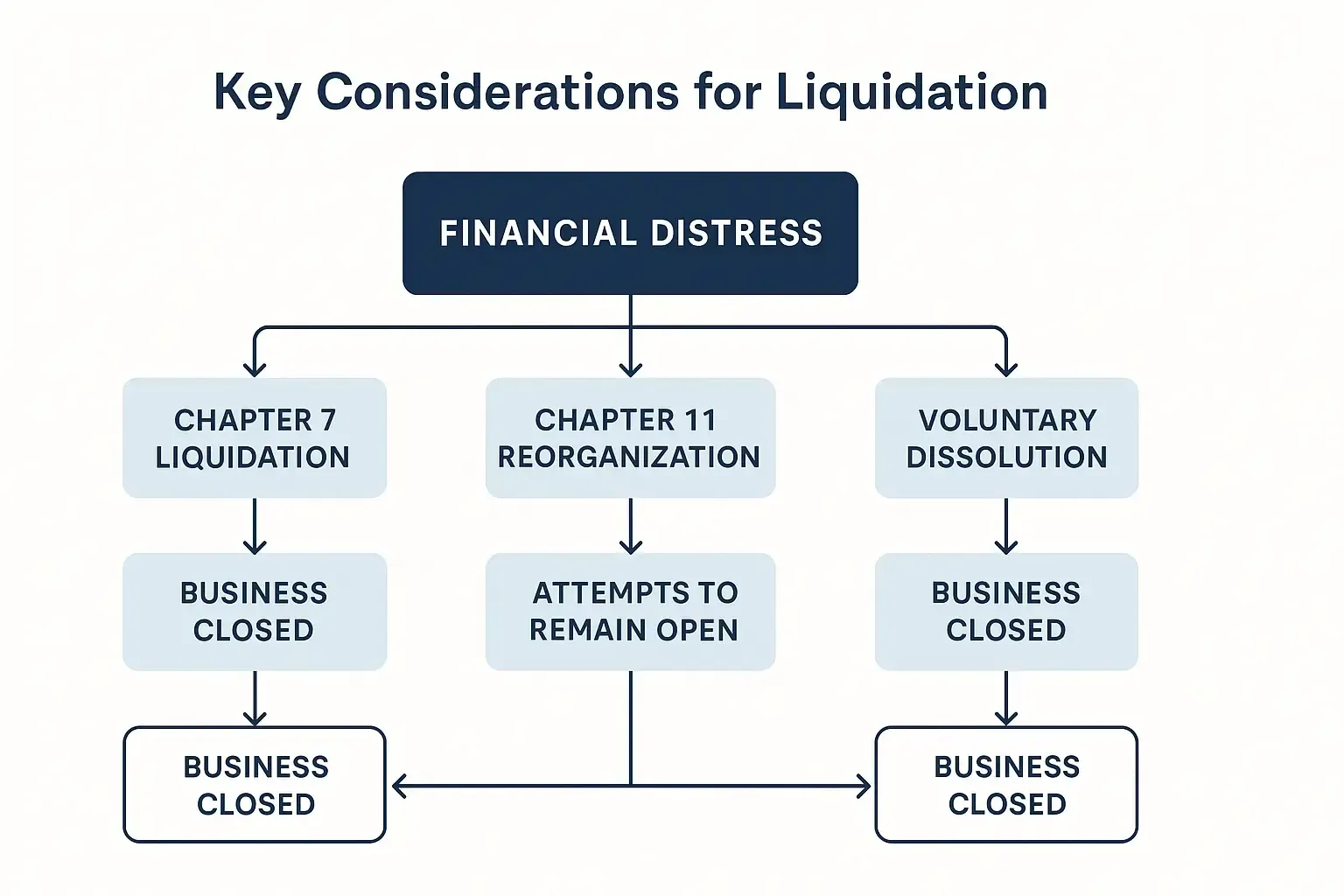

- Chapter 7 Bankruptcy (Liquidation): This is the most common form of liquidation for businesses in the U.S. It involves a court-appointed trustee taking control of the company's assets, selling them off, and distributing the proceeds to creditors in a legally mandated order. Once the process is complete, the business is officially dissolved. This applies to corporations, partnerships, and sole proprietorships.

- Chapter 11 Bankruptcy (Reorganization, but can lead to Liquidation): While primarily designed for businesses to reorganize their debts and continue operations, a Chapter 11 case can sometimes convert to a Chapter 7 liquidation if a successful reorganization plan cannot be achieved. In such instances, the reorganization effort fails, and the business proceeds to liquidate its assets.

- Voluntary Dissolution (Non-Bankruptcy Liquidation): For solvent companies, a "voluntary dissolution" process is initiated by the company's shareholders or directors outside of bankruptcy court. This involves systematically winding down operations, selling assets, paying off all debts, and distributing any remaining funds to shareholders. This is a strategic choice for businesses that are not insolvent but wish to cease operations for various reasons.

It's also important to recognize how the concept of "liquidation" extends beyond traditional business closure. In the e-commerce sector, for example, "sourcing liquidations" refers to the practice of acquiring bulk quantities of customer returns, overstock, or discontinued items from retailers or manufacturers. For resellers, this offers the potential for rock-bottom prices, but it comes with inherent risks like defective inventory and inconsistent product quality. In the rapidly evolving world of decentralized finance (DeFi), "liquidation mechanisms" refer to automated processes that occur when a borrower's collateral falls below a certain threshold, forcing the sale of their digital assets to cover a loan. These diverse applications highlight the fundamental concept of converting assets to cash to satisfy obligations across different domains.

When is Liquidation the Right Path? Key Considerations

Deciding whether liquidation is the appropriate course of action for your business requires a thorough assessment of several critical factors. This isn't a decision to be taken lightly, but rather one that necessitates clear-eyed analysis and professional guidance.

- Financial Solvency: The most fundamental question is whether your company is genuinely insolvent. This means either your liabilities significantly exceed your assets, or, more commonly, you are simply unable to pay your debts as they become due. An honest and objective assessment of your financial position, often through a detailed review of balance sheets and cash flow statements, is the absolute first step.

- Viability of the Business Model: Is there any realistic, sustainable prospect of turning the business around? This involves more than just wishful thinking. It requires a hard look at market demand, operational efficiency, competition, and your ability to secure new funding. If the underlying business model is no longer viable in the long term, liquidation might be the most responsible option.

- Director's Personal Situation and Risks: Consider your personal exposure. Have you signed personal guarantees for company debts? What are the potential personal liabilities if the company continues to incur debt while insolvent? The immense stress of managing a failing company can also take a significant toll on your mental and physical well-being. Understanding these personal stakes is crucial.

- Professional Advice: Above all, seek immediate and qualified professional advice. This cannot be overstated. Engage with a licensed bankruptcy attorney, a financial advisor specializing in distressed businesses, or a certified public accountant with expertise in insolvency. These professionals can assess your specific situation, explain all available options (including formal reorganization under Chapter 11, which aims to help distressed businesses recover), and guide you through the complex legal requirements and potential pitfalls. Their expertise is invaluable in navigating what can be a daunting process.

U.S. Business Liquidation Trends: What You Need to Know

U.S. business liquidations are on the rise. Recent data highlights a growing trend:

- Increasing Bankruptcies: Business bankruptcy filings in the U.S. climbed 14.7% by March 2025 (compared to March 2024), reaching 23,309 cases.

- Chapter 7 Dominance: A large portion of these are Chapter 7 bankruptcy filings, directly leading to liquidation.

- Affected Sectors: Retail and small-to-mid-sized businesses are particularly vulnerable to rising interest rates and supply chain issues.

- Economic Pressures: This increase reflects broader economic trends and challenges, underscoring that liquidation remains a reality for many businesses.

These business failure statistics show a clear pattern of increasing financial stress across various sectors.

Conclusion: Navigating Business Endings with Strategic Foresight

The question of whether business liquidation is "good" or "bad" is rarely simple. It's not merely a mark of failure, but rather a complex, formal, and often necessary process for U.S. businesses facing severe financial distress or for solvent enterprises seeking an efficient, strategic exit.

For directors and entrepreneurs, understanding this corporate dissolution process means recognizing its dual nature. While it presents significant challenges—from the loss of control and potential reputational impact to the invocation of personal guarantees—it also provides a lawful, orderly path to resolution. My experience consistently shows that timely and informed decision-making is paramount; delaying action often escalates financial and personal burdens.

By engaging with qualified U.S. legal and financial professionals early, you can explore all available options—from formal reorganization under Chapter 11 to various forms of liquidation, including streamlined Chapter 7 bankruptcy filings or corporate dissolutions. This proactive approach empowers you to choose the strategy that best protects your interests, minimizes adverse impacts, and, crucially, preserves your ability to pursue new ventures.

Ultimately, navigating a business's end demands foresight and resilience. When managed correctly, business liquidation is not the final chapter, but often a definitive turning point toward a new, more viable beginning.